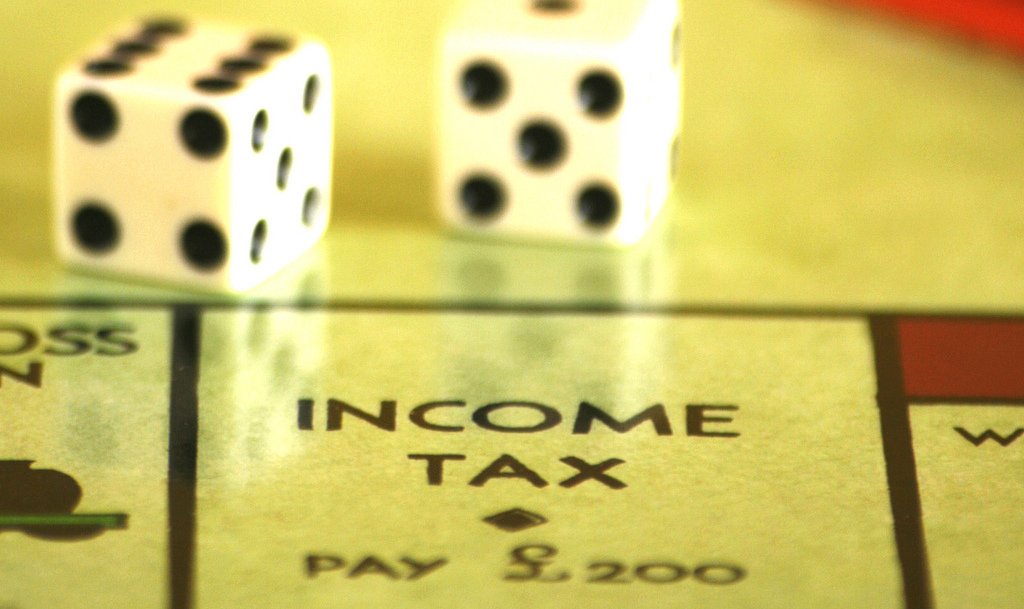

Today is tax day in the US (the day on which federal income tax returns are due). I find filing my tax returns a dreadful chore, one that returns each year and always seems like a waste of effort. My tax day this year fell on April 1st, as I’m a registered citizen in the Netherlands rather than in the US. I had to perform the task while still on the road, which made it extra annoying. (Of course I had had almost 3 months to complete the task, but of course I let it come down to the very last week.) Since I have a pretty efficient accounting system in place, it didn’t take that much work to get it done. Most effort went into retrieving the end-of-year statements from various bank accounts through their respective online banking systems.

The unfriendly IRS

So now I’m expecting a friendly marginally polite letter from the Dutch IRS (the ‘Belastingdienst’) any time, asking ordering me to fork over a large amount of money. It’s the same each year: I receive a formal letter (or more than one), printed on blue paper, telling me in harsh words that I should pay up. If I don’t, bad things will happen, etc. I just don’t get this. I’m a law-abiding citizen, and by filing my tax returns I’m complying with the legal-fiscal system. I’m not the guy they should be threatening. I’m the guy they should keep happy so he will keep filing and paying his taxes on time each year.

If that huge ‘Belastingdienst’ organization would employ just one PR specialist (or even an intern!), it could keep people so much happier about paying their taxes. Draw up some nice letters, the kind you would send to a valued customer. Send a ‘thank you’ message instead of a ‘statement’. Provide a glimpse of insight into all the nice and valuable things being done with that tax money. Give people the sense that they are a valued contributor and that their tax contribution is being put to good use.

Fundraising in the (not) for profit world

Most big corporations these days publish a corporate social responsibility (CSR) report in addition to their annual report. While I read these reports mostly as bullshit, they do manage to instill in me a warm and fuzzy feeling. They make me feel (though often not rationally believe) that a company is doing Good things. If I were a shareholder, I would be just that bit more proud of my company, and be more inclined to tell my friends about it. (Have you ever heard anyone at a party or barbecue boast about how they are making so many great things happen because they pay a lot of taxes?) More importantly, it would reduce the chance of me selling off my shares.

Modern day charities are another interesting case. They are a far cry from the well-meaning amateurs who once tried to improve the world with their makeshift solutions. Now charities have to compete vigorously for the generosity of people, both with each other and with the various more selfish ends that people like to spend their money on. To achieve this, they employ highly paid CEOs (often to the disgruntlement of their volunteers), expert marketing managers, and armies of young and enthusiastic fund raisers. The average charity will have highly effective sales mechanisms in place to make you feel good about parting with some of your money in order to support their cause.

Make paying taxes more fun

Why do I bring up these examples? Because they show how you can get someone’s money and make them feel good about it. The IRS has characteristics of both a charity and a big corporation: it raises funds and uses them either to redistribute among the less-well-off or to produce public goods. In order to do so, it employs a vast bureaucracy. Why can’t this organization learn something from charities and corporations?

The answer is, of course, pretty simple. The IRS neither has to compete with other tax collecting agencies, nor does it have to keep its shareholders particularly happy. As opposed to the shareholders of public companies, tax payers can’t ‘vote with their feet’; they can’t sell their shares and simply buy into another tax regime*. Without these external threats, it is easy for the taxman to become complacent, and just take the fact that people pay their taxes for granted.Yet this thinking is wrong. Enforcement of the tax code is costly, and it is much better for the IRS if people pay their taxes willingly. It is also better on a political level. Paying taxes is a huge part of our contribution to society. While politicians try to win over or keep voters by showcasing their results, no effort is made to make the financing of those results more pleasant. By making an effort to address tax payers nicely, and showing them how valuable their contribution is, the IRS could make a big improvement both in tax code compliance and overall satisfaction with the government.

The Dutch ‘Belastingdienst’ has a famous motto it communicates in many of their tv commercials: “Leuker kunnen we het niet maken, wel makkelijker”. This roughly translates into: “We can’t make it [paying taxes] more fun, but we can make it easier”. This is exactly wrong. The IRS should be trying hard to make paying taxes more fun.

*Or actually, most tax payers can’t, because they’re tied to their country by a job, a mortgage, and a family. If you live a life like mine, you could pack up pretty easily, provided that you can get a visa for another country (easier for some than others). I might very well do this one day soon. I hardly spend any time in ‘my’ country anyway, and I have very little connection with it other than that some of my friends and most of my relatives live there. But for now I have to deal with the Dutch Belastingdienst for my taxes.

Woah! I’m really enjoying the template/theme of this site. It’s simple, yet effective. A lot of times it’s hard to get that “perfect balance” between superb usability and visual appeal. I must say you’ve done a superb job with this. In addition, the blog loads super fast for me on Safari. Exceptional Blog!